The

SCENE

Probably it happened

for the first time ever that “Idea” came in after action!! Are you amazed the

same way like I was with this news? Ok, let me come to the center story without

beating around the bush. Bharti Airtel slashed its 4G data offering rates by 80%

and soon after, Idea cut its 3G/4G rates by up to 67%. Coming up next is

Vodafone that is expected to cut data offering rates soon. And guess who is the

devil behind this master game… Yes!! You you’re right!! Reliance Jio it is!!!

The Mukesh Ambani-led

Reliance Group, with its revolutionary product – Reliance Jio, is giving

sleepless nights to major service providers in the telecom sector. Even before

its commercial launch, Reliance Jio claimed to have 15 lakh subscribers of its

4G network. The SIM card of Reliance Jio comes bundled with LYF smartphones

priced as low as Rs 2,999. Jio is offering 90 days of free unlimited 4G mobile

Internet and voice calling in the SIM cards. And now, this offer has been

extended to OEMs like Gionee, Karbonn, Lava and Xolo. A pricing masterstroke it

seems!!

But the real question

here is whether this entire scenario of data rate cuts, driven by Reliance Jio,

is really beneficiating Indian consumers!!

Government’s

Expectations v/s Expected Reality

The Government of India

is expecting to raise $83 Billion from the mega sale of mobile frequencies, the

biggest ever auction, starting from October 1, 2016. There have been, however, building

doubts on the success of spectrum auction raised by industry experts who say

that the base pricing of the base airwaves is quite high.

There is still another

big underlying story that is expected to affect the sale of this spectrum.

Aggressive price war to

retain the market share has already led the highly debt-laden carrier companies

to lower their tariff rates by a highly substantial amount which is expected to

give a blow to the revenues of the carriers. (On August 30, 2016 i.e. a day

after Bharti Airtel declared a slash in 4G rates by about 80%, its stock fell

by about 3%).

(Source:

Bloomberg)

Adding to the headache

of these companies is the gloomy outlook on the telecom sector. As per a report

published by Fortune, between 2012 and 2018, the Indian telecom sector is set

to lose $386 Billion due to the increasing usage of services like Skype,

WhatsApp, Lync etc. with data tariffs falling continuously as a result of the

service providers getting in a fierce price war to retain their market share.

(Source:

Bloomberg)

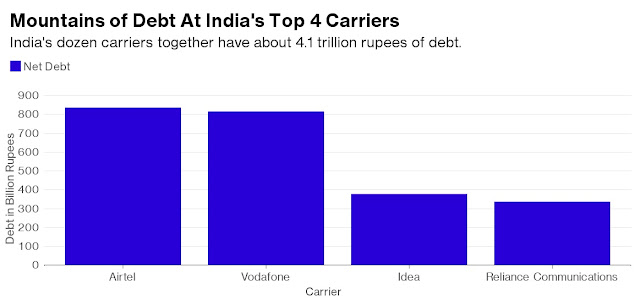

As per Bloomberg’s

latest report, India’s 12 wireless companies carry more than $61 Billion in

debt. A credit ratings agency – ICRA (A Moody’s Investors Service Company) had recently

estimated that in the scenario of high debt already on the books of carrier

companies, falling revenues from voice calls and now the aggressive data tariff

cuts by the service providers, the carriers may spend just $9.7 Billion in the

upcoming auction.

What

the Industry has to say…

When asked about their

strategy of future business in India due to shift of consumers’ attention from

voice calling to VoIP, Vodafone’s Head of Organizational Effectiveness said

that, “At the moment we realize that the telecom is increasingly becoming a

cut-throat market, our present strategy lies in making Vodafone a leading

market player in India.”

On Reliance Jio’s

product rollout, Idea’s chairman Kumar Mangalam Birla said in an interview with

ET Now that Idea is going to bid very sensibly in the spectrum auction. “We

have got a larger player like Jio entering the market with a large presence on

the ground, in terms of huge asset base, a player with very deep pockets and it

is bound to be disruptive. So, I think for all of us incumbents, it is going to

be a tough two years but it will be exciting to see how it plays out” said Mr.

Birla in the interview on July 27, 2016.

Worrying on the level

of return that the auction shall give, Telenor ASA has said that it won’t be

bidding in the auction as the return are not up to an acceptable level.

As per the estimates of

International Data Corp., the Indian smartphone base will reach to 600 million

by 2020. This requires improving the coverage would hence be crucial for the

service providers. While Bharti Airtel has not commented their stance on the

upcoming auction, Sunil Sood (Managing Director, Vodafone) has said that

Vodafone will bid for the spectrum. It is further expected that Vodafone shall

turn out to be the largest bidder in the $83 Billion spectrum auction starting

from October 1, 2016.

Government

in a deep soup?

While it is expected

that the carriers will bid for just $9.7 Billion in the auction, it directly

implies that the government will be facing a blow of $73 Billion (a huge

amount!!!) leading to failure (87% expected shortfall) of the biggest spectrum auction

that has ever happened in India (a major event!!). This in turn will raise

doubts on the capability of government to meet/fulfill its projected economic

activities. (Doubts on the capabilities of one of the most capable

governments?? Definitely not a good news!!)

Blogger’s

Comments

Over and above this,

recent reports of the least exploration of oil this fiscal year since 1947 has

put speculation among market analysts who are taking caveats at meeting the

future oil demands. This substantial fall in exploration (least in the past 70

years) will soon lead to a shortfall in the oil supplies. A global spending on

exploration has been already cut to $40 Billion this year from about $100

Billion in 2014, and this is in turn mounting more doubts on the future outlook

of oil markets. Global benchmark Brent stood at $49.59 a barrel on August 30,

2016. With expected drop in oil supply and growing demand, if oil prices go up

by a notable amount, it would further add to the import bill (oil imports make

up 80% of India’s import bill), doing nothing but increasing headache of Indian

government in addition to

Higher Import Bill &

fair exports (in the face of stagnant global demand) => Higher CAD =>

Impact on Forex Rates => Higher Inflation => Lower Real Interest rates

=> Lower deposit in banks => worrying bank outlook => lower loan

growth => New RBI governor Dr. Urjit Patel will find it difficult to cut

repo rates => Market will raise doubts on Dr. Patel as a good governor =>

Doubtful outlook on Indian Economy => Investments in the economy affected

=> Dr. Raghuram Rajan’s work goes in vain (No, we don’t want this to

happen!!!)

From one scenario,

where consumers are seemingly getting an advantage of the gigantic data rate

cuts by the carriers, looking at the expected broader macro-economic data, does the

consumer actually seem to be getting the advantage? Is Reliance Jio actually

benefitting Indian consumer?

Amidst our speculations, let’s wait and watch

what actually happens on October 1, 2016. Stay tuned!!

- Harsh Pathak

Student and Core Committee Member of Finance Club at MISB Bocconi - Bocconi India

Very well written buddy, specially the impact and the problems new RBI governor might face

ReplyDeleteVery well written buddy, specially the impact and the problems new RBI governor might face

ReplyDelete